The 3 Bucket System. Predictable, Sustainable income through retirement

Retirement is more complex than most people realize. What does the life you imagine really look like? Will market ups and downs impact your income? How do you plan for inflation that never seems to slow? And what happens if your goals and your partner’s goals do not fully align?

We’ve helped thousands of people, advising over $175 million on how to plan for and navigate retirement.

Life happens in retirement but it doesn’t mean that you’ll end up running out of money 15 years too early. Healthcare costs do go up, there are annual home repairs, the car transmission goes and it’s fix it or replace it. Life doesn’t stop happening because we retire. The important thing is that we know these types expenses are coming, so we plan ahead.

What Makes Us Special?

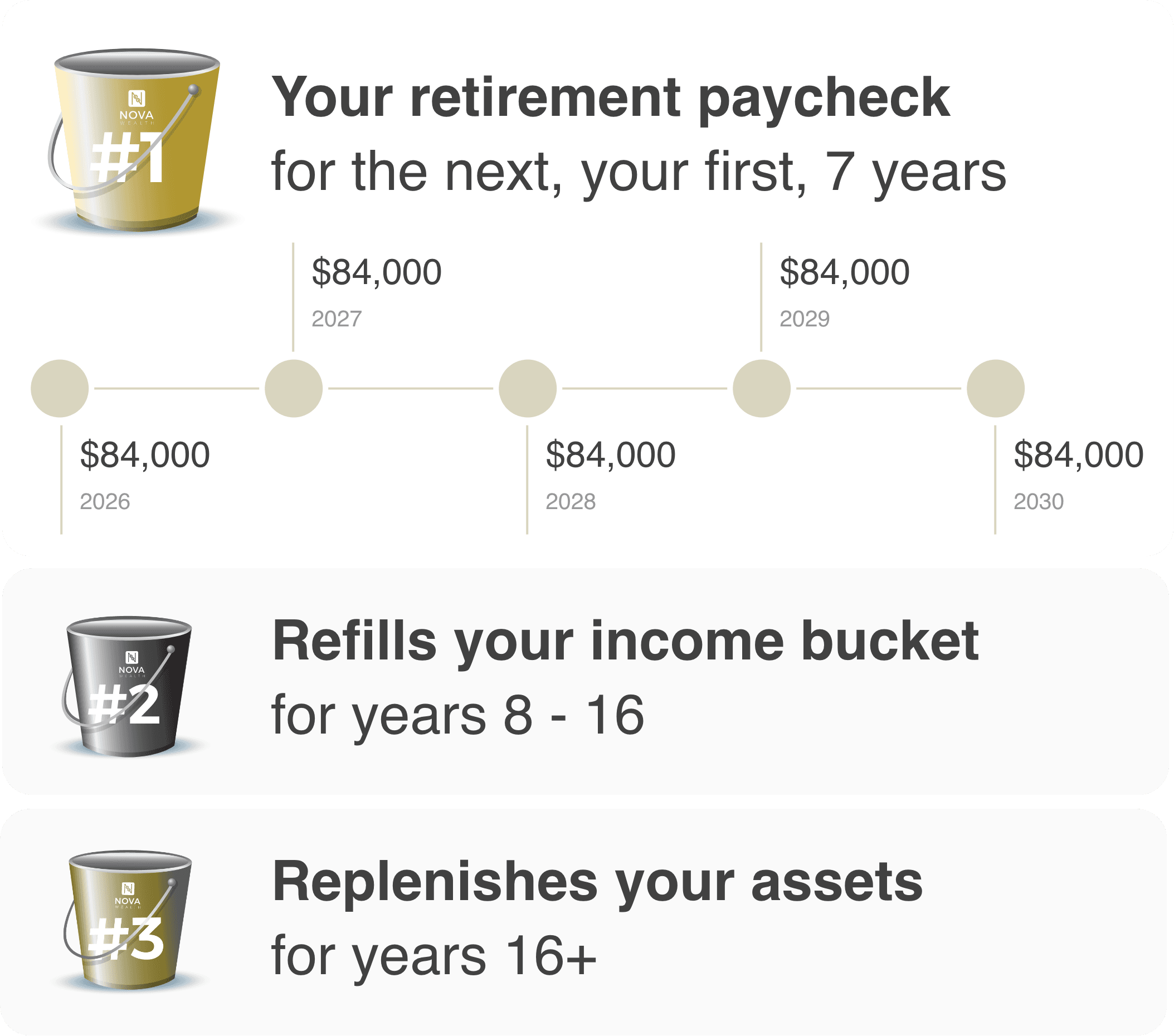

Our 3 Bucket System that focuses on the most important years of retirement, the first 7 years. 60% of retirement plans fail, and never recover, due to poor returns in those first critical years. Our 3 Bucket System protects those first 7 years so that unfortunate market timing doesn’t turn into the failure of your retirement plan. However, what really makes us special is that we are the same as the people we serve. We have families, we aren't ready to retire yet, and we're still navigating what's most important to us. Do we want to retire 10 years early or have more capital and income to travel more or escape to Florida for the winter. The plans we run for you, we also run for ourselves.

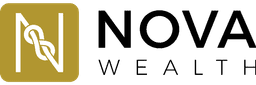

What is the 3 Bucket System, and how does it work?

What is the 3 Bucket System, and how does it work?

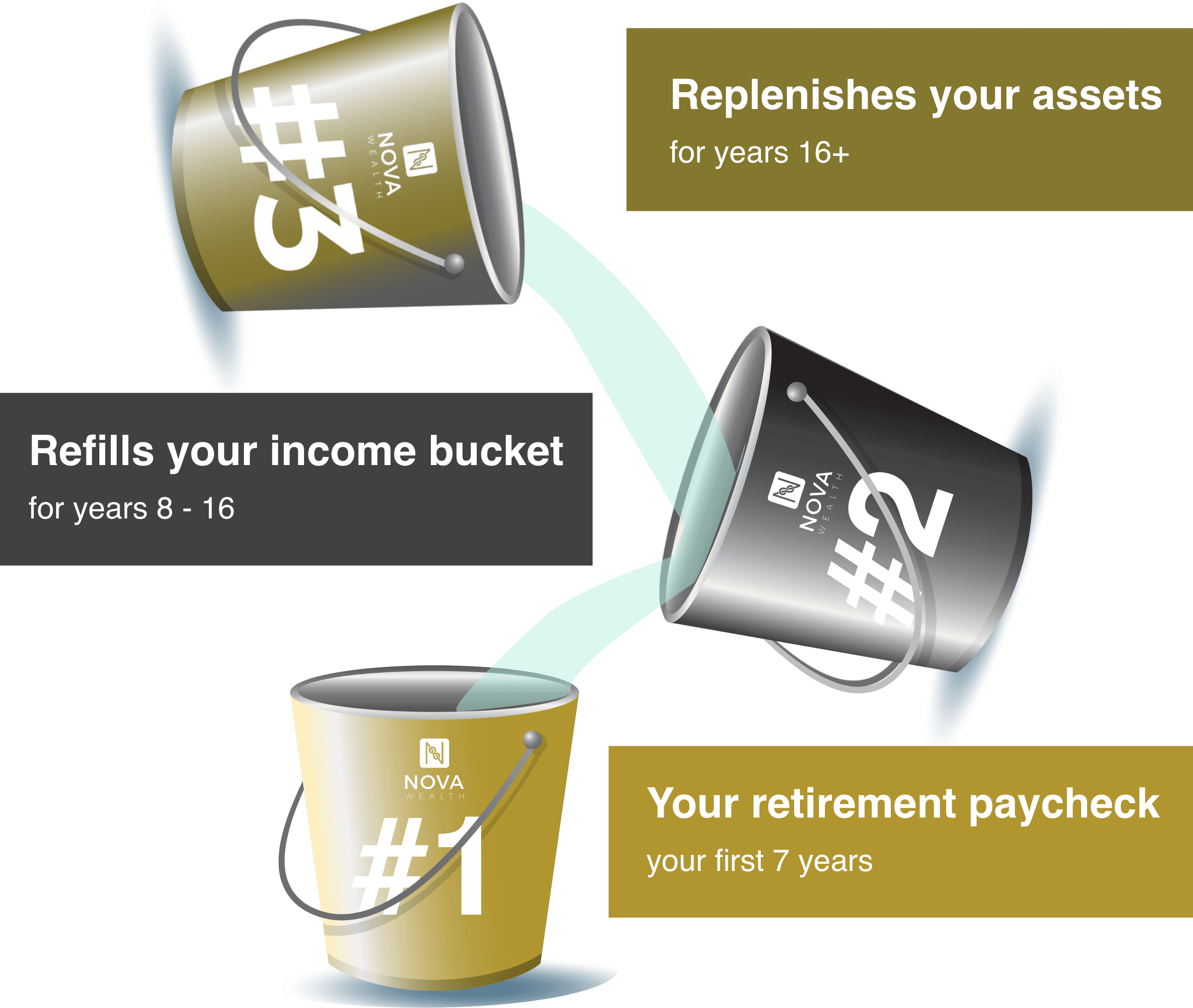

The three-bucket system is designed to simplify the retirement planning process and cover every factor that matters, through each stage of retirement, from the first 7 critical years to the final years regardless of whether your retirement lasts 20 years or 40.

Focuses on medium term stable growth to refill bucket 1 by year 8. Bucket 2 is a mix of conservative and growth investments.

Focuses on long term growth investments to preserve the wealth needed to refill Bucket 2, and outpace projected inflation.

Why Bucket 1 is Mission Critical

Why Bucket 1 is Mission Critical

Many retirees rely on a basic allocation strategy - investing in a 60/40 portfolio and withdrawing 4% annually. The Challenge. The common 60/40 portfolio can be devastating if you retire in a down market. Your portfolio may never recover due to sequence of returns risk where poor returns early in retirement permanently damage financial security. We create investment strategies driven by when you'll spend your money. Our proven 3-bucket system creates predictable, sustainable income during those first 7 years, and medium to long term investments that can benefit from and wait for the market cycles that lead to asset growth.

Your Personalized 3 Bucket Retirement Plan

Your Personalized 3 Bucket Retirement Plan

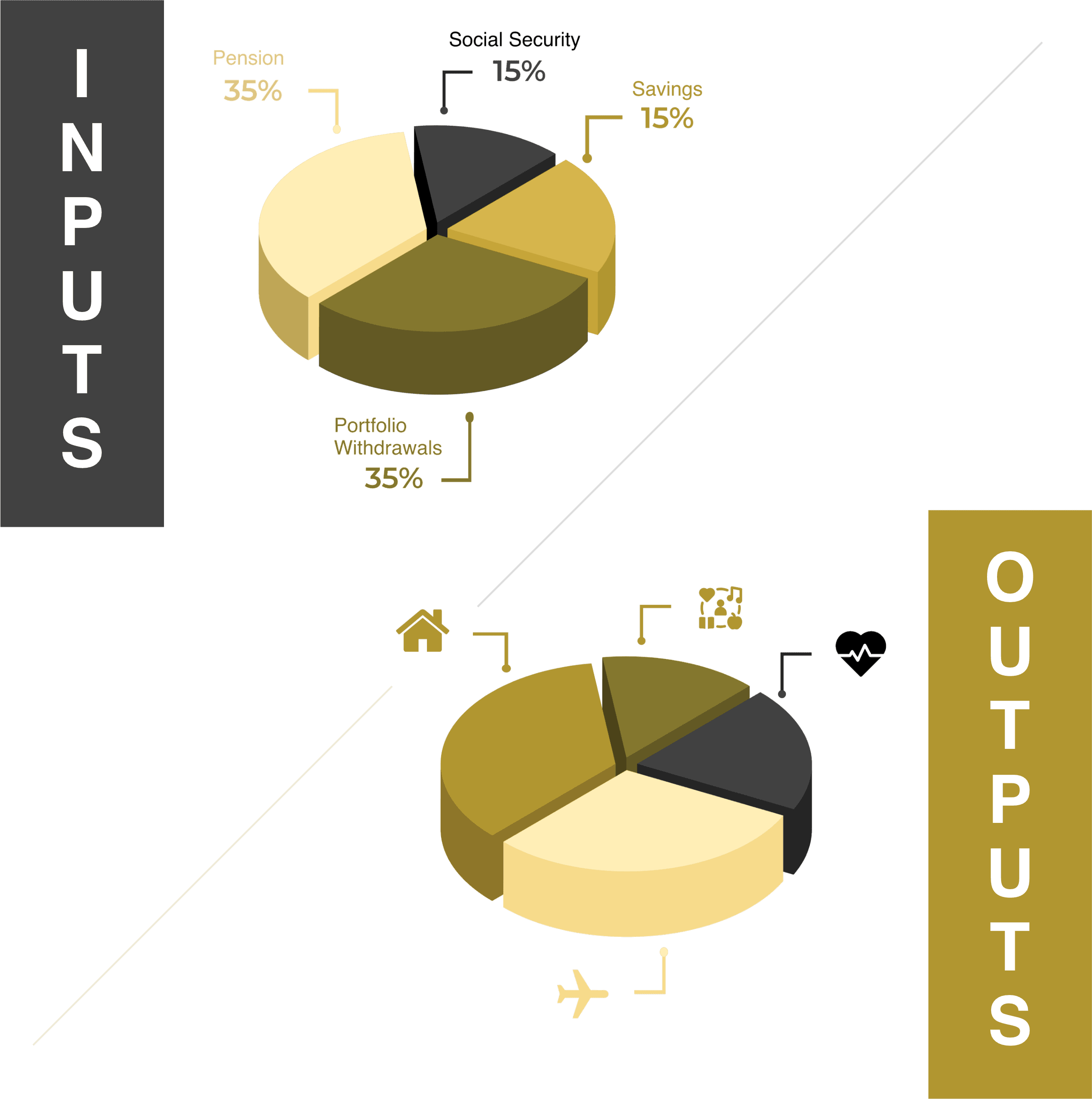

If you decide to work with us the first step is putting together your personalized 3 bucket plan. This process includes a deep dive into your current and projected income by source (such as Social Security, 401K or Pensions), and expenses based on where you live including healthcare costs, taxes, and inflation based cost of living adjustments.

Step 2 is a deep dive on the impact your geographic plans will have on cost of living increases from inflation, increased taxes, or insurance.

The final step is putting together your 3 Bucket Plan. The 3 bucket plan has 3 simple but key complimentary puzzle pieces, each with what if scenario models built into the budgets:

- Bucket 1 (Years 1 - 7) stability of income

- Bucket 2 (Years 8 - 15) higher return to refill bucket 1

- Bucket 3 (Years 16+) asset growth to refill bucket 2

Talk with Us

Elizabeth Evanisko, CRC

Wealth Manager, Founding Partner

About Elizabeth

Since 2007, Elizabeth has been bringing her compassionate, honest approach to client relationships along with her extensive professional experience. As a Wealth Manager, she has a deep commitment to helping people and enjoys the opportunity to work one-on-one with clients and help them identify their most important goals and dreams. Clear, direct advice geared toward each individual is a hallmark of Elizabeth’s style. She appreciates the hard work that went into earning and saving the money that is being entrusted to her care as a significant responsibility. Growing up - my dad owned an auto repair shop that my grandfather started. He worked with generations of people who trusted my family. Crawling under a car never enticed me, but the relationships he built on trust lasted for generations. This career allows me to have those things too.

Education and Licenses

SUNY Fredonia graduate with a double major in economics and political science.

Series 6, 26, 63 and 65 registrations.

Life, Accident & Health Insurance license.

Jeff Gelormini

Wealth Manager, Founding Partner

About Jeff

Throughout his career, Jeff has maintained his focus on helping people by making a difference in their lives. As a Wealth Manager since 2011, he thrives on helping clients make important financial decisions that allow them to achieve their long-term goals. Jeff works with clients from all walks of life, primarily professionals who seek long-term financial solutions but gets the greatest satisfaction from constructing retirement income plans that create predictable, sustainable income. Before becoming a Wealth Manager early in his career, Jeff was the Tight Ends Coach, Assistant Offensive Line Coach, and Assistant Recruiting Coordinator at Albright College, giving him coaching skills that he still applies today. Jeff believes strongly in the importance of providing financial education for his clients to empower them to make sound and informed decisions.

Education and Licenses

Ashland University educated with a major in Sport Management and Communications and a minor in Business Administration.

Series 6 and 63 registrations.

Life Insurance licensed.

Brett Komm, CSSCS, CRC

Wealth Manager

About Brett

Brett comes from a family that has dedicated their lives to serving people in their community. He grew up seeing the trials and tribulations of a family-owned business and knew that he wanted to do something that had a positive impact on people’s lives. Math and problem-solving were skills that he had always excelled at, and the Financial Services Industry was a perfect match. Brett takes the time to get to know his client’s needs and wants financially. He walks them through past experiences and maps out their financial future in different time frames. Helping them manage expectations and set achievable goals that they can work towards. There are a lot of talented people in our industry, and with advances in technology, people can find a lot of information that may be able to help them with their financial goals. When I sit down with new clients, I tell them we are entering into a relationship. I could be the smartest person in finance, but if they don’t know that I truly care about their lives/goals, then my impact won’t be felt. I believe the time I take to understand my clients and guide them to make decisions is the only way to build a strong relationship.